Botswana’s Success: Good Governance, Good Policies, and Good Luck

Michael Lewin

This article is an excerpt from Chapter 4 of Michael Lewin’s book, “Botswana’s Success: Good Governance, Good Policies, and Good Luck.”

Over the past 60 years, the economy of Botswana has been one of the most successful in the world. The country’s achievement is remarkable, because at independence, in 1966, its prospects were not encouraging.

ECONOMIC AND SOCIAL INDICATORS OF BOTSWANA

Botswana is a sparsely populated, arid, landlocked country; at independence, it was also one of the poorest countries in the world, with a per capita income of just $70 a year. In the first few years of independence, about 60 percent of current government expenditure consisted of international development assistance. There were only 12 kilometers of paved roads, and agriculture (mostly cattle farming for beef production) accounted for 40 percent of gross domestic product (GDP).

By 2007 Botswana had 7,000 kilometers of paved roads, and per capita income had risen to about $6,100 ($12,000 at purchasing power parity), making Botswana an uppermiddle-income country comparable to Chile or Argentina. Its success is also evident in other measures of human development. At independence, life expectancy at birth was 37 years. By 1990 it was 60, 10 years above the African average. Under-five mortality had fallen to about 45 per 1,000

live births in 1990, compared with 180 for Africa as a whole.

Development assistance has shrunk to less than 3 percent of the government budget, and agriculture currently accounts for only about 2.5 percent of GDP. Major strides have also

been made in infrastructure and education.

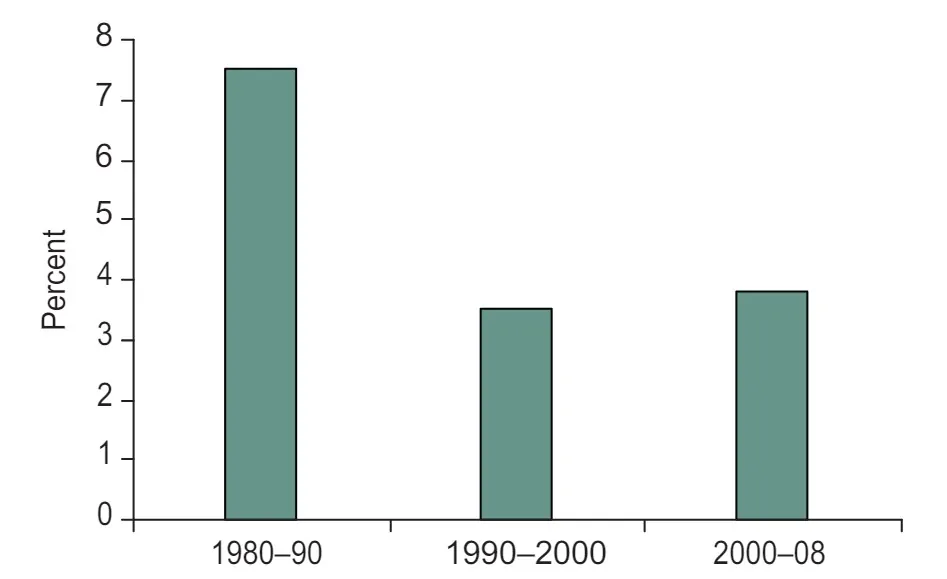

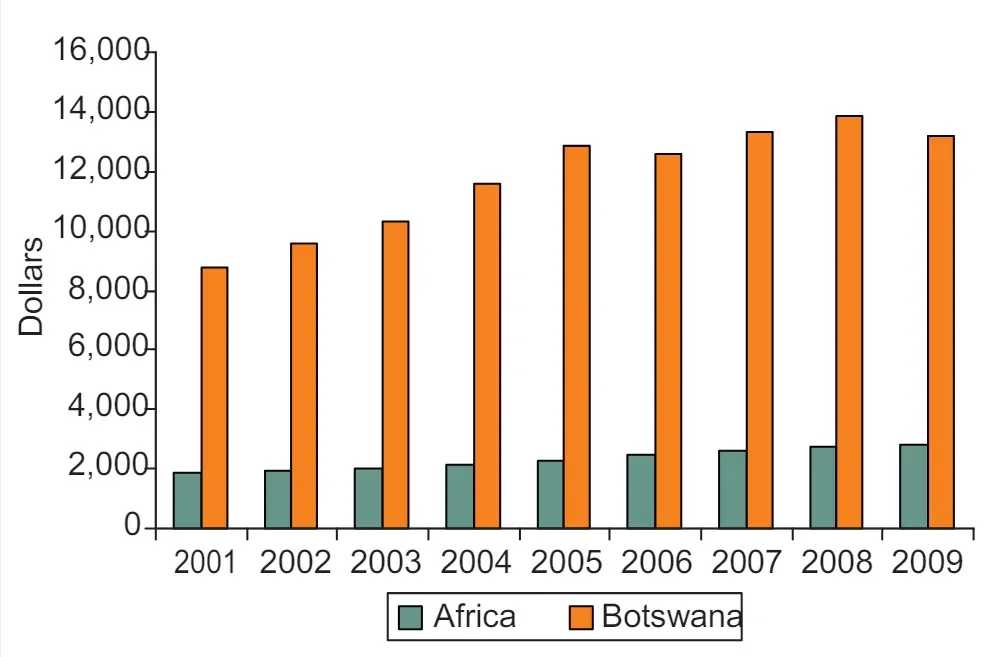

Annual growth in per capita income averaged 7.0 percent between 1966 and 1999 (table 4.1 and figure 4.1). The country’s performance is particularly impressive compared with that of other African economies (figure 4.2).

Critics have argued that the social gains from this growth have been somewhat limited. In fact, in addition to the gains in health and life expectancy noted above, there have been gains in poverty reduction and education. The proportion of poor people fell from about 50 percent in 1985 to 33 percent in 1994, and the proportion of people completing at least primary school rose from less than 2 percent at independence to about 35 percent in 1994 (Leith 2005).

Not all indicators are as positive: income distribution in Botswana remains very unequal (the Gini coefficient was about 0.55 in 1994). Unemployment remains high, reflecting to a large extent rural to urban migration, although it too has fallen, dropping from about 21 percent in the 1990s to about 17 percent in 2008.

BOTSWANA: DIAMONDS AND DEVELOPMENT

Botswana’s extraordinary growth was fueled by minerals, particularly diamonds. At independence, beef, the country’s main export and largest sector, contributed 39 percent of GDP. From independence until the 1970s, international aid dominated the government budget and was the main source of foreign exchange. At that time the mineral sector, mainly diamonds, began to take off and soon became the dominant sector. Income growth and the growth of the mining sector accelerated in tandem from about 1974/75 until recently.

Table 4.1: Annual Growth in per Capita Income in Selected Economies, 1966–99

Figure 4.1: Average Annual Growth in per Capita Income in Botswana, 1980–2008

Luck—the discovery of diamonds as well as other important minerals—was clearly an element of Botswana’s success. However, there is considerable disagreement over whether the discovery of minerals in a developing economy generally brings good luck or bad (box 4.1).3 Indeed, many countries in Africa, including Zambia, Nigeria, the Democratic Republic of Congo, Sierra Leone, and others, have squandered vast amounts of their natural wealth. One does not have to be persuaded that natural resources are necessarily a curse to conclude that they certainly are not sufficient for economic success or even a good predictor of it. In the case of Botswana, minerals turned out to be lucky, but other key ingredients in the recipe for success were present, including good governance and good economic management.

Figure 4.2: Average per Capita Income in Africa and Botswana, 2001–09 (purchasing power parity at current dollar prices)

Mineral-based countries seem to be prone to bad government, a phenomenon Acemoglu and others have termed “good economics, bad politics.” In almost all developing countries, the government owns the mineral resources and is therefore the main recipient of the revenues from their extraction. This concentration of revenues with the government as the conduit of benefits to the rest of the economy can lead to a host of problems, including rent-seeking, corruption, and the efficiency losses that result from them. It is not surprising that, with easily accessible wealth concentrated in the hands of the government, malignant dictatorships and predatory regimes often thrive. There also seems to be a greater tendency for armed civil conflict in mineralbased economies (Collier and Hoeffler 2004). These “bad politics” are extremely costly

Botswana has avoided these manmade disasters. Part of its success may reflect luck: Botswana’s relatively homogeneous population has less potential for ethnic polarization, which when combined with mineral rents can be particularly combustible. Still, most of the credit must be given to the leadership, which, since independence, has designed and fostered the conditions of governance that have ensured stability and social and economic progress. The government established respect for property rights and the rule of law. It maintained a high degree of transparency, which was reinforced by continuing the Tswana tribal tradition of consultation. These consultative institutions, known as kgotla, created a degree of trust in the government—the sense that government exists to serve the people and promote development and is not the instrument of one group or individuals for the purpose of getting hold of the wealth. Tswana tradition also respected private property; the fact that many of the tribal leaders who helped usher in modern government were also large cattle owners may have reinforced this respect.

Acemoglu and Robinson (1999) emphasize that property rights and the rule of law are the key factors explaining development success. They also emphasize the importance of the preindependence colonial regime in determining the adoption of these institutions after independence. More heavily settled colonies tended to establish institutions to maintain the rule of law and enforce property rights; in sparsely settled colonies, the colonial regimes tended to be more “extractive” or “exploitative,” unconstrained by law and respect for property. Although Botswana’s colonial past is not typical of the kind of regime that usually led to a postindependence government constrained by law and property rights, its unique colonial history had the same effect.4 Before independence, Botswana was a British protectorate, the colonial power having been “invited” in. Because Botswana was not colonized for economic or strategic advantage, the colonial rulers, it is argued, did not impose the extractive-type regime often found in other sparsely populated areas. Thus the regime that evolved after independence was one that respected the law and property and was dedicated to development.

More controversial is the role of democracy. Botswana has maintained a parliamentary democracy since independence. To be sure, its democracy is not perfect: the country has had one-party rule since independence, women’s representation is limited, and there has been some criticism that minorities (particularly the San people) are not treated equally. Nevertheless, the government functions in a democratic manner, elections are “free and fair,” and the government is responsive to the electorate and transparent in its dealings.

Is democracy a positive factor for economic growth and development? None of the miracle East Asian economies or Latin America’s high performer (Chile) was democratic during the first years of rapid growth and development, leading many commentators to conclude that property rights and the rule of law are more important than democracy (Acemoglu, Johnson, and Robinson 2003). For some observers, democracy is actually a hindrance to economic development. Although this conclusion is probably unwarranted, the fact that many democracies (such as India) have not fared well economically undoubtedly means that democracy is neither sufficient nor necessary for growth and development.5

In the case of mineral-rich countries like Botswana, democracy may be an important catalyst. Mineral-dependent economies seem to spawn the predatory type of dictatorship rather than the relatively benevolent ones of East Asia’s past. Although this notion is largely speculative, it seems that a democratic government dependent on mineral wealth is more likely than a dictatorial one to be responsive to development needs, to settle disputes peacefully, and to respect the rule of law. Very few, if any, mineral-rich countries in Africa have been ruled as peacefully and productively as Botswana; it is hard to escape the conclusion that the democratic institutions established at independence are an important part of the explanation.

Social science cannot rigorously assess the relative importance or contribution of leadership in the evolution of successful institutions. However, in the case of Botswana, leadership, particularly that of its first president, Seretse Khama, may have been crucial, especially in the areas of mineral exploitation and the rights of the state versus those of the tribes. The discovery of minerals can easily lead to civil war and the dissolution of the state. To prevent this from happening, even before independence, Khama’s party, the Botswana Democratic Party (BDP), wrote into its platform its intention to assert the state’s rights to all mineral resources. After independence, the government reached agreement on ownership of mineral resources with the tribal authorities. Although the largest diamond deposits were discovered in Khama’s own district of Bamangwato, he chose the country over his tribal land, thus helping limit the possibility of conflict. Discover how Botswana’s blend of good governance, effective policies, and favorable circumstances has driven its success by exploring detailed insights on Global Property Guide.

Box 4.1 The Resource Curse

The counterintuitive notion that the endowment of natural resources is a curse rather than a blessing has become received wisdom. Sachs and Warner (1995) report regression results showing that being a natural resource or mineral exporter reduces a country’s development prospects. Many other researchers find evidence to support this claim (see for example, Auty 2004 and the references therein). The fact that most of the East Asian tigers (the Republic of Korea; Taiwan, China; Hong Kong SAR, China; and Singapore) plus Japan are resource poor has added to the perception that endowed wealth is an obstacle to growth and development

There is certainly evidence that a disproportionate number of the poorest countries are dependent on mineral exports. The direction of causality, however, is far from clear: does mineral dependence retard development, or does retarded development create mineral dependence?

Accounting for the endogeneity of mineral dependence overturns the Sachs-Warner conclusions. Countries that fail to develop remain resource dependent, but resource abundance may be correlated with higher growth (see, for example, Brunnschweiler and Bulte 2008; Alexeev and Conrad 2009). Many rich countries— including Canada, Australia, Norway, the United States, and Latin America’s top performer, Chile—were or are mineral dependent. In Africa the two richest countries, South Africa and Botswana, owe much of their wealth to gold and diamonds.

In short, resources are not necessarily a curse, but many countries have squandered their resources, and in some cases, the presence of mineral resources may have contributed to economic stagnation or decline. What is it about mineral endowments that can make things go wrong?

Dutch Disease

Dutch disease refers to the deleterious effects that purportedly result from the real appreciation of the currency caused by a booming resource export sector (Corden and Neary 1982). The discovery of minerals or an increase in their international price leads to an increase in income and expenditure. As long as some of the increased expenditure goes to domestically produced goods, there will be a real appreciation of the currency, which causes productive resources to move from nonmineral traded goods, the output of which declines, to nontraded goods, the output of which increases. The resulting excess demand for tradables can be financed by the revenue from the mineral exports.

Because the entire process is initiated by an increase in income, expenditure, and consumption, it is not clear why it should be thought of as a disease. One reason given is the presence of positive externalities in the declining sector. The declining traded goods sector is thought to have spillover effects that contribute to longrun growth and industrialization. Hence, the real appreciation caused by mineral exports is said to cause “deindustrialization,” contributing to poor long-run performance. Of course, in Africa and Botswana in particular, the declining traded goods sector was agriculture, not industry (there was no significant industry to deindustrialize). Some might argue that mineral exports prevent the real depreciation needed to industrialize. Additionally, it is argued, the mineral sector fails to stimulate the nonmineral sector through linkages to the rest of the economy.

Against this effect, one must weigh the advantages that minerals bring in terms of increased saving and hence investment, which should offset any loss of competitiveness caused by the real exchange rate. Moreover, because government is usually the chief beneficiary of the resource revenues, the increase usually eases constraints on public goods, such as infrastructure, education, and health, which should contribute to growth and industrialization. If private investment or public goods expenditure fails to materialize, the problem lies not in the real exchange rate but rather in the failure of financial markets to allocate the saving and investment productively or of government to invest wisely.

The Volatility Curse

Mineral prices tend to be volatile, which, it is argued, destabilizes the economy (Hausmann and Rigobon 2003). This volatility affects the economy through the exchange rate, which appreciates in the boom and depreciates in the bust, and through fiscal policy, which tends to be procyclical, leading to inefficient “stop-go” provision of government services and infrastructure projects. a It is argued that the perceived riskiness that this volatility engenders leads to lower investment, particularly foreign direct investment, which seeks out safer markets. In addition, governments tend not only to increase spending when current revenues rise but often also to believe that revenues will continue to rise; they therefore borrow against future revenues. Instead of being able to use accumulated assets to help in the bust, economies find themselves contending with debt overhang.

It is possible to insulate the domestic market from the volatility of the commodity markets. Because the government is the conduit of the cycle to the economy, it is also the solution. The key is to delink expenditure and revenue, essentially by saving all or part of the revenues, thereby replacing a volatile income stream with a more stable one. Expenditure can then be based on this more stable, permanent income. In this way, consumption can be smoothed over time, in some cases over generations. Many countries, including Botswana, Chile, Kuwait, Norway, Qatar, and Saudi Arabia, have successfully applied such an expenditure-smoothing policy.

Botswana: The Governance Curse

In most developing countries the government claims ownership of all minerals. If government institutions are weak to begin with, there is a strong likelihood that the resources will be squandered. In addition, the presence of the resources may weaken and corrupt government. The relative ease with which mineral revenues are collected can lead to a lack of transparency and accountability. The resulting interdependence of government and the mining industry reinforces this tendency. Government itself is seen as the means to acquiring wealth, which typically leads to rent seeking and corruption. There is also evidence that in many cases mineral wealth provokes or fuels internal conflicts (Collier and Hoeffler 2004).

In an ironic metaphor, underground minerals are often referred to as one of the “commanding heights” of the economy. Postindependence governments claimed the need to control these commanding heights for the benefit of all the governed. One of the unforeseen consequences of this policy was the perception that control of government is the path to wealth, which in turn, unsurprisingly, has often led to regional and ethnic conflict for control of these resource rents (Collier and Hoeffler 2004).

Exhaustibility

Minerals are a windfall, even in the long run, in the sense that they are finite and that when they are depleted an economic slump will occur. That a blessing does not last forever hardly makes it a curse, however. If at least some of the windfall is saved, in the form of physical and human capital or financial assets, future generations will benefit from it. Moreover, the depletion usually does not occur suddenly. With some foresight, the adjustment and transition can be cushioned by accumulated saving. b

How Has Botswana Fared?

To a large extent, Botswana overcame the threat of the resource curse:

- Dutch disease was avoided, most significantly by government investment in public goods and infrastructure. The government also took measures to help boost productivity, by limiting parastatals and avoiding import substitution policies.

- The volatility curse was overcome by unlinking public expenditure from revenue. The government established savings funds and avoided typical procyclical behavior and real exchange rate volatility.

- The governance curse was avoided, through a series of actions described in the chapter. Botswana’s success in this regard is exceptional.

- The question of whether the exhaustibility challenge has been met remains unclear. If current predictions are correct, diamond revenues will begin declining in 2016 and could be exhausted by 2029. Botswana has adopted many of the appropriate policies to prepare for the depletion of its mineral base, by accumulating funds for the future, building infrastructure, and investing in health and education. However, the growth of the nonmineral traded goods sector, which has remained flat at about 5 percent of GDP, will need to accelerate to avoid balance of payments problems as diamond revenues begin to decline.

a. Rather than being procyclical, in most developing countries, the government initiates the cycle because it is the recipient of the rents. The boom therefore begins with government expansion and the bust with its contraction. Hence, real exchange rate variability is also the result of volatile government expenditure.

b. A full discussion of mineral resource management in the context of intertemporal and intergenerational allocations goes beyond the objectives of this chapter. Essentially, the optimal management of resource rents requires expenditure smoothing not only to avoid cyclical volatility but also to spread the benefits of the windfall over time. Like a rational household, an optimizing government will attempt to base its long-run expenditure on some calculation or estimate of its “permanent” or stable revenue rather than on its current or transitory revenue. For some calculations of permanent income in the case of Botswana, see Basdevant(2008).

IMPLEMENTING GOOD POLICIES IN BOTSWANA

All mineral-based economies face the issue of an appreciating real exchange rate (box 4.2). The well-known possible harmful consequences of this are often referred to as Dutch disease (see box 4.1). Prevention of Dutch disease in Botswana consisted of three key components: fiscal saving, a surplus on the current account of the balance of payments, and heavy government investment in infrastructure and human capital. Together these policies limited the erosion of domestic productivity and competitiveness that can result from the appreciation of the real exchange rate. High fiscal saving limits current consumption, reducing pressure on domestic price inflation, a typical problem in natural resource booms. Some of the government saving took the form of offshore investments, which directly limited real exchange rate depreciation and diversified the sources of future foreign exchange revenues. The accumulation of reserves is a form of self-insurance against short-run declinesin mineral revenues as well as long-run reductions in these revenues as a result of mineral depletion. The instruments of public saving took the form of the Public Service Debt Management Fund and the Revenue Stabilization Fund. These funds have proved to be successful mechanisms for managing fiscal saving; income from the Revenue Stabilization Fund is now a stable source of government revenue.

Another part of the fiscal saving was channeled to domestic assets, combating the effect of the loss of competitiveness by raising productivity. When this investment is focused on public goods (for example, infrastructure, health, and human capital), it will contribute to growth without crowding out private sector investment and development. Public sector saving was positive in every year between 1975 and 1996, fluctuating between 10 and 40 percent of GDP. Public sector investment was fairly constant at about 10 percent of GDP. 6 However, if one counts expenditure on health and human capital as investment, government investment has consistently remained about 20 percent of GDP. The capital budget focused on basic infrastructure with about 30 percent devoted to water, electricity, roads, communication, and transportation. Twenty percent of the capital budget, on average, went to education and around 30 percent of recurrent expenditures was devoted to education and health.7 While quantifying the effectiveness of public expenditure on growth and development is notoriously difficult, particularly in resource-based economies where soft budget constraints may lead to overinvestment, the emphasis on infrastructure, health, and education seems to have served Botswana well. As noted above, the number of paved roads increased from around 20 kilometers in 1970 to 2,300 in 1990; 90 percent of the population had access to safe water (compared with 29 percent in 1970); and the number of telephone connections rose from around 5,000 in 1970 to 136,000 in 2001.8 Similarly, in educational achievement Botswana leads Africa. For example, adult literacy, male and female, is around 80 percent compared with 69 percent and 50 percent, respectively, for the rest of sub-Saharan Africa.9

As a result of its prudent fiscal policy, Botswana has enjoyed relative macroeconomic stability and avoided the boom-slump cycles that characterize many mineral-based economies. Monetary policy was also restrained: for most of the postindependence period, inflation was moderate, averaging about 10 percent (Maipose n.d.). The periodic slowdowns in the diamond industry have thus by and large not been passed on to the rest of the economy. By withholding some of the benefits from the economy during the booms, the government has, to some extent, been able to insulate it from the busts.10

Box 4.2 Windfall Economics 101

The mechanism by which mineral resource flows affect the real exchange rate depends on the nominal exchange rate regime maintained by the country. Botswana has a fixed exchange rate system. Initially, it pegged its currency to the U.S. dollar. When the South African rand depreciated relative to the dollar, Botswana suffered from the appreciation of the pula (Botswana’s currency) relative to the rand (the currency of its main trading partner).a The pula is therefore now pegged to the rand.

In a fixed-rate regime, the first effect of a resource windfall is the creation of an excess supply of foreign exchange. To maintain the peg, the monetary authority must accumulate reserves. Doing so will inject domestic money into the economy, however, resulting in domestic price inflation, which will eventually erode local competitiveness until the balance of payments surplus is eliminated. This is the effect of real appreciation when the nominal rate is fixed. To prevent this from happening, the government has to sterilize the effects of the resource rents on the domestic money supply. In the medium to long run, the fiscal authority can do so by absorbing the excess domestic money through fiscal budget surpluses. This policy of twin surpluses—a balance of payments surplus in tandem with a fiscal budget surplus—is essentially the policy that Botswana has followed. (Some analysts have argued that China has followed a similar policy to maintain an undervalued currency.)

a. In contrast, Argentina maintained a dollar peg after the devaluation of the Brazilian real. Many analysts consider this a key element leading to the Argentine crisis.

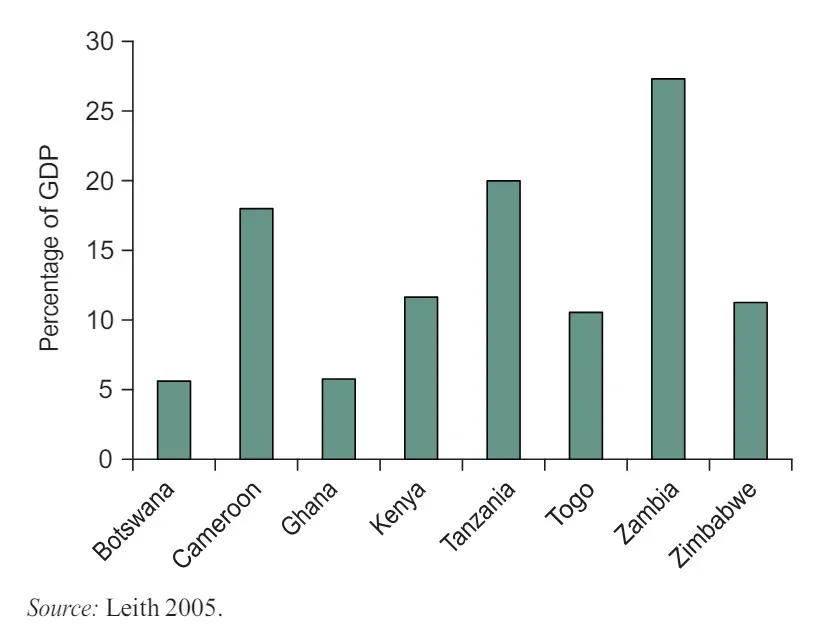

Shunning import substitution and parastatals

Two things Botswana did not do are also significant. Unlike many African countries, it did not adopt a policy of import substitution, and it did not expand the extent of stateowned productive entities, which employ only about 5 percent of the workforce in Botswana (figure 4.3).

Figure 4.3: Percentage of GDP Accounted for by State-Owned Enterprises in Selected African Countries, Early 1990s

Being part of the South African Customs Union (which required cooperation with the then odious regime in South Africa) meant maintaining a fairly low tariff regime and provided a steady stream of government revenue. Avoiding an activist import-substituting policy and maintaining limited government involvement in production seems to have paid off for Botswana by allowing it to avoid many of the inefficiencies and structural deficits that so often arise from such policies.

Trade policy is also an area where good governance and good policies reinforce one another. A government rich with mineral revenues is an inviting target for rent seekers and worse; restricting the avenues for rent seeking and corruption thus helps preserve the efficiency and integrity of the government. Even if the theoretical merits of import substitution or the existence of state-owned enterprises seem persuasive, in practice both often result in inefficiency and drain fiscal resources.

Good fiscal policies by themselves may not be sufficient for success. Many mineral-based economies with high rates of investment have not enjoyed the positive results that Botswana has. The quality of investment is evidently as important as the quantity. Moreover, in the hands of the venal and corrupt, government savings funds can easily turn into slush funds for the favored elites. There may be a lesson in this from Botswana: good governance will aid the effectiveness of good policy, and good policy encourages better government. Policy formulators should therefore not ignore the political economy consequences of economic policy. Botswana’s combination of policy and governance evidently helped it avoid the worst effects of the resource curse.

BOTSWANA: PLANNING FOR A FUTURE WITHOUT MINERALS

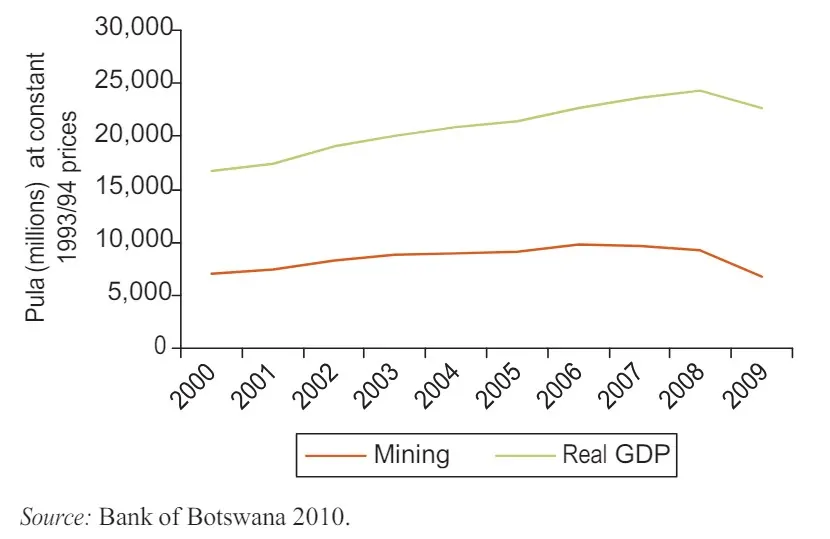

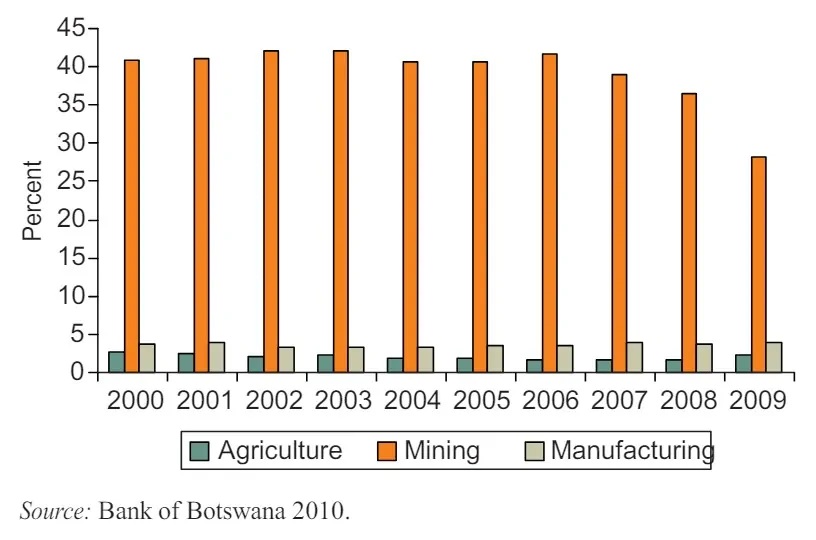

Botswana is still a mineral-based economy: it has not succeeded in significantly diversifying its economy away from diamonds. Government remains the largest employer (employing 30 percent of the active workforce); other than minerals (which employ a relatively small share of workers), most production is in nontraded goods. This pattern is typical of mineral-dependent economies. Real GDP and mining income have moved in tandem since 2000 (figure 4.4), and mining consistently accounts for about 40 percent of GDP, completely dwarfing the contributions of manufacturing and agriculture (figure 4.5).11 Minerals, mostly diamonds, comprise about 85 percent of exports, and mineral revenues account for about 50 percent of government revenues (Bank of Botswana 2008). 12

Figure 4.4: Mining Revenues and Real GDP in Botswana, 2000–09

Figure 4.5: Contributions of Mining, Manufacturing, and Agriculture to Botswana’s GDP, 2000–09

The diamond industry is expected to decline in the near future, with revenues projected to begin falling in 2016 and to be depleted by 2029 (Basdevant 2008). If these projections are correct, adjustment is inevitable and unlikely to be painless, although Botswana’s prudent policies—particularly regarding saving and investment—have left it in a relatively strong position to facilitate a soft landing. For most years, domestic saving has been above 40 percent and investment about 35 percent of GDP. (The difference is the surplus on the current account of the balance of payments.) This impliesthat from the perspective of the economy as a whole, all revenue from minerals is being saved rather than consumed, because total saving from national income is roughly equal to mineral income. When mineral revenues begin to decline, some of the adjustment could thus be absorbed by saving rather than consumption. Thus, even if growth slows, consumption growth can be maintained as the proportion of consumption to income rises.

The government has also been a big saver. Central bank profits and other income from accumulated assets now make up about 30 percent of government revenue, most of it income from the accumulated saving of mineral revenues. At times, the overall fiscal surplus rose to more than 30 percent of GDP (Maipose n.d.), and public sector investment (as noted) has been consistently about 10 percent of GDP. If investment is defined more broadly to include human capital and health, public investment rises to about 20 percent of GDP, which meets the IMF benchmark for sustainability (Basdevant 2008). The government has used this accumulated savings to smooth expenditure over the business cycle, thus providing the economy with a short-run shock absorber. However, as argued in box 4.1, the accumulated saving is also a long-run shock absorber, because it has built up human and physical capital and financial assets that should serve the economy well during the adjustment period. In addition, the accumulated foreign assets managed by the Bank of Botswana now amount to about 40 months of imports.

These advantages notwithstanding, Botswana faces serious challenges. Dependence on mineral exports is the key weakness of the current economic outlook and diversification of the traded goods sector is the most important policy objective. Accumulated foreign assets and the income from them can ease the welfare cost of adjustment, but it cannot eliminate it. Barring a miraculous jump in productivity, some real depreciation of the pula and the consequent hardships this may cause, will be necessary to create the competitiveness needed to replace falling mineral exports.

In 2009 manufacturing contributed less than 5 percent of GDP (see figure 4.5). This share will have to rise if Botswana is to avoid decline. The fact that manufacturing has been flat as a proportion of income conceals its growth, because just keeping pace with Botswana’s growing economy has required rapid growth.13 However, manufacturing growth will have to accelerate if Botswana is to raise or even maintain its standard of living in the long run.

Key to such growth will be Botswana’s ability to attract foreign direct investment (FDI). Although FDI fell between 2002 and 2007 (Bank of Botswana 2010), Botswana’s reputation as a stable country and successful economy should help it attract FDI in the future.14 Policy makers should examine the country’s overall investment environment with a view to attracting desirable investment.15

Clouding Botswana’s smooth transition to a more diversified economy is HIV/AIDS, which hit Botswana harder than any country in Africa (with the possible exception of South Africa). The epidemic has reversed many of the impressive gains in health indicators achieved over the past 100 years and reduced productivity. The number of deaths from AIDS began declining in about 2003 (World Bank 2009), but the costs and consequences of the epidemic will persist for many years.

CONCLUSION

The country’s vast natural resources played a key role in this accomplishment, but the mere endowment of resources is clearly not the whole story. In much of Africa—and in other parts of the world—natural resources have not always been conducive to growth and development; in many cases they seem to have brought out the worst in countries, in the form of conflict and predatory governments.

Studying the effect of mineral wealth on economic outcomes is timely, because the increase in the prices of natural resources as a result of the rise of China and India is likely to result in windfalls for many African countries. How can countries turn these windfalls into long-run growth and development? In Botswana’s case, the key to successfully harnessing natural resources lay in good governance and good policies. Governance has not been perfect in Botswana, but it has been good. Botswana has been largely free of kleptocracy and civil conflict; it has maintained a transparent, law-abiding government; and it has implemented good policies, including a hyper-prudent fiscal policy, which has done much to diversify foreign exchange earnings and prevent the volatility that typifies many resource-based economies. Investments in human and physical capital and vast improvements in infrastructure have also raised Botswana’s productivity, which, together with its substantial financial reserve in the form of foreign assets, should help ease the transition to a more diversified economy.

NOTES

1. For discussions of Botswana’s success, see Maipose (n.d.), Acemoglu and Johnson (2003), and Leith (2005).

2. Leith (2005) notes that when measured accurately, taking into account social, health, and educational services provided by the government to the poor, this measure falls to about 0.53. No measure of inequality is without serious analytical problems; the Gini coefficient is probably the best available and most widely used index. The coefficient ranges from 0 (perfect equality) to 1 (perfect inequality). The higher the index, the more unequal the society. An index above 0.5 is thought to denote an unequal distribution (Leith 2005).

3. See, for example, Auty (2004) and Sachs and Warner (1995). For a contrary view, see Stevens (2003) and Brunnschweiler and Bulte (2008). See also Lederman and Maloney (2007).

4. The analysis is based on the idea that some colonial regimes were mostly “extractive”—that is, the regime existed to reap the maximum out of the colony’s economy. Other regimes, usually ones in which there were more colonial settlers, were less extractive. They often established institutions that put more constraints on the extractive and arbitrary powers of government. These constraining institutions often carried over into independence.

5. All of the high-performing developing countries mentioned have established strong democratic institutions. The question therefore arises whether the causality runs the other way, from growth to democracy. It can also be argued that democracy is necessary to sustain a high-income economy (see Barro 1997).

6. Isham and Kaufmann (1999) estimate this proportion (10 percent of GDP) to be the likely ceiling for public investment to remain productive. Beyond this they find public sector investment is likely to be detrimental to growth.

7. Lange and Wright (2002) point out that the only single “nonproductive” item of comparable weight in the budget was defense expenditure, which average about 11 percent of total expenditure. While this is high relative to most countries Botswana arguably had good reason to do this.

8. World Bank cited in Lange and Wright, 2002, 32.

9. World Bank 2009. Botswana, however, lags other upper middle income countries in these categories.

10. Botswana has not been able to escape the effects of the current global crisis: GDP declined 4 percent in 2009, and for the first time in many years, Botswana had fiscal and balance of payments deficits. However, the economy appears to have weathered the worst, with the Bank of Botswana projecting real growth of more than 3 percent for 2010 and 2011.

11. Mining’s share fell in 2009 because of the slump in world trade, not because of the declining importance of the sector.

12. Between 2005 and 2008, before the effects of the global slump set in, exports grew by about 40 percent. The share of diamonds fell from about 75 percent in 2005 to about 65 percent in 2008. Total mining remained more or less constant, however, at about 85 percent of total exports. The share of diamonds fell because of rising copper and nickel exports (Botswana Central Statistical Office 2009).

13. Other areas of interest are services, including financial services; downstream diamond processing and trading; and tourism, which represented about 10 percent of GDP in 2008 and is a potential growth sector for export earnings.

14. FDI rose again in 2008. It is too early to tell whether this is a trend.

15. Botswana had the best ranking in Africa on Transparency International’s corruption perception index in 2011 and ranked 33rd worldwide. On the World Bank’s 2010 Ease of Doing Business index, Botswana ranked 3rd regionally but only 52nd worldwide, indicating some room for improvement.

REFERENCES

Acemoglu, D., S. Johnson, and J. A. Robinson. 2003. “An African Success: Botswana.” In In Search of Prosperity: Analytical Narratives on Economic Growth, ed. D. Rodrik. Princeton, NJ: Princeton University Press.

Acemoglu, D., and J. A. Robinson. 1999. “On the Political Economy of Institutions and Development.” American Economic Review 91 (4): 938–63.

Alexeev, Michael, and Robert Conrad. 2009. “The Elusive Curse of Oil.” Review of Economics and Statistics 91 (3): 586–98.

Auty, R. (ed.) 2001. “Resource Abundance and Economic Development.” Wider Studies in Development. Oxford University Press, Oxford, UK.

Bank of Botswana. 2008. Annual Report. Gabarone. ——. 2010. Botswana Financial Statistics. Gaborone.

Barro, R. 1997. Determinants of Economic Growth: A CrossCountry Empirical Study. Cambridge, MA: MIT Press.

Basdevant, O. 2008. “Are Diamonds Forever? Using the Permanent Income Hypothesis to Analyze Botswana’s Reliance on Diamond Revenue.” IMF Working Paper, International Monetary Fund, Washington, DC.

Botswana Central Statistical Office. 2009. External Monthly Trade DigestJanuary. Gaborone.

Brunnschweiler, C. N. and E. H. Bulte. 2008. “The Resource Curse Revisited and Revised: A Tale of Paradoxes and Red Herrings.” Journal of Environmental Economics and Management 55: 248–64.

Collier, P., and A. Hoeffler. 2004. “Greed and Grievance in Civil War.” Oxford Economic Papers 56, Oxford University, Oxford, UK. ———. 2005. “Democracy and Resource Rents.” Oxford University, Oxford, UK.

Corden, W. M., and P. J. Neary. 1982. “Booming Sector and Deindustrialization in a Small Open Economy.” Economic Journal 92: 825–48.

Hausmann, R., and R. Rigobon. 2003. “An Alternative Interpretation of the ‘Resource Curse’: Theory and Policy Implications.” NBER Working Paper 9424, National Bureau of Economic Research, Cambridge, MA.

Isham, J., and D. Kaufmann. 1999. “The Forgotten Rationale of Policy Reform: The Productivity of Investment Projects.” Quarterly Journal of Economics 116 (1).

Lange, G., and M. Wright. 2002. “Sustainable Development in Mineral Economies: The Example of Botswana.” Ceepa Discussion Paper Series, University of Pretoria, Pretoria, South Africa.

Lederman, D., and W. F. Maloney, eds. 2007. Natural Resources: Neither Curse nor Destiny. Washington, DC: World Bank.

Leith, J. C. 2005. Why Botswana Prospered. Montreal: McGill-Queen’s University Press.

Maipose, G. n.d. Policy and Institutional Dynamics in Sustained Growth in Botswana. University of Botswana, Gaborone.

OECD (Organisation for Economic Co-operation and Development). n.d. Africa Economic Outlook.

Sachs, Jeffrey D., and Andrew M. Warner. 1995. “Natural Resource Abundance and Economic Growth.” NBER Working Paper W5392, National Bureau of Economic Research, Cambridge, MA.

Stevens, P. 2003. “Resource Impact: Curse or Blessing? A Literature Survey.” Journal of Energy Literature 11 (1): 3–42.

World Bank. 2009. Country Partnership Strategy for the Republic of Botswana. Washington, DC.