2024 Botswana Real Estate Market Analysis

This comprehensive overview presents a detailed examination of the performance of the Botswana real estate market throughout 2023, drawing comparisons with preceding years and offering prognostications for the year 2024. It furnishes valuable insights into the dynamics and trends that delineate the country’s property sector.

MARKET PERFORMANCE IN 2023

Residential Rentals Market

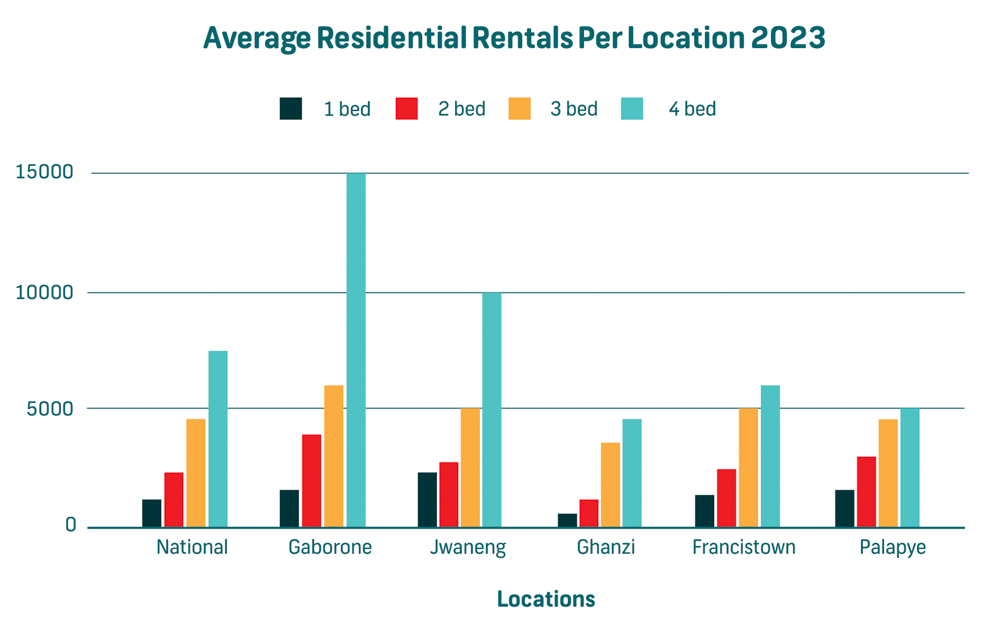

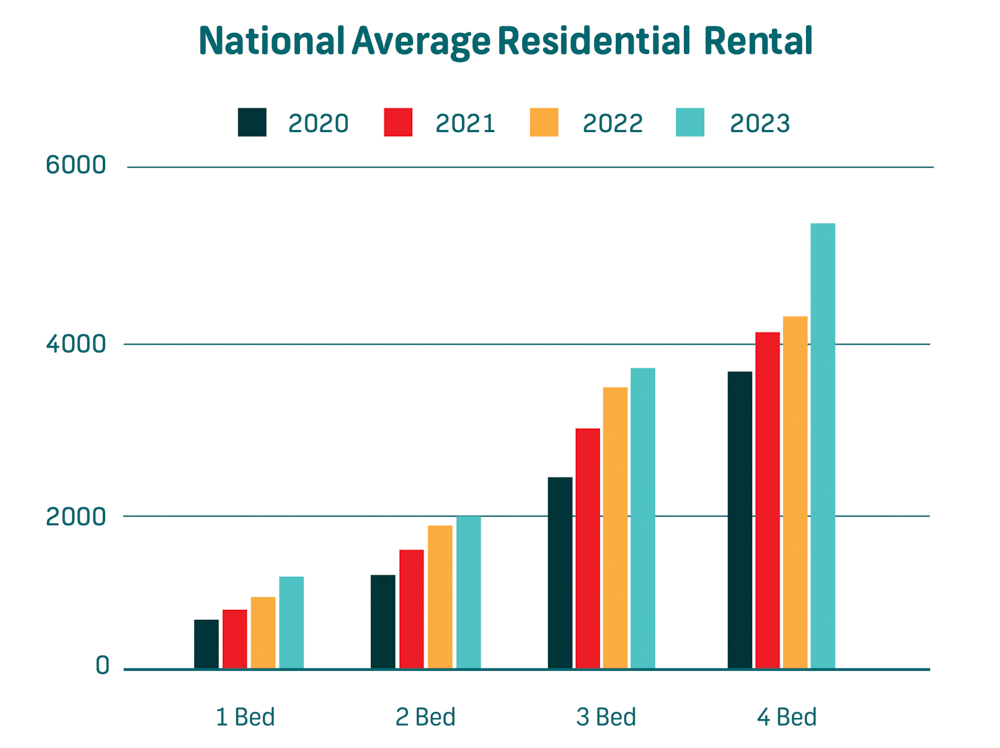

Recent observations indicate a general upswing in rental rates across the country, reflecting a broader trend in the real estate market. Various factors contribute to this phenomenon, including increased demand for rental properties, changing economic conditions, and evolving housing preferences. As rental rates are often indicative of the overall health of the property market, this trend raises pertinent questions about the underlying dynamics.

GABORONE’S DISTINCTIVE RISE IN 3 AND 4-BEDROOM SEGMENTS

Notably, Gaborone stands out with a significant surge in rental rates, particularly in the 3 and 4-bedroom segments. This specific trend warrants a closer examination to understand the unique factors influencing the rental landscape in the capital city.

POTENTIAL LINK TO PROPERTY AUCTIONS AND FINANCIAL RECOVERY

Upon closer analysis, there is a discernible correlation between the increase in rental rates, especially in larger housing configurations, and the number of properties facing default and subsequent auction. It appears that individuals, facing the impending auction of their mortgaged properties, are opting to secure alternative accommodation through rentals. This strategic move aligns with a broader narrative of financial recovery, as these individuals seek stability and flexibility in the face of property-related uncertainties.

Impact on the Rental Market Dynamics

This shift in the rental market dynamics underscores the resilience of the rental sector as a viable option for individuals navigating financial challenges related to property ownership. The 3 and 4-bedroom segments, in particular, witnessed heightened demand, possibly driven by families seeking spacious and accommodating living arrangements during times of transition.

Sales Prices:

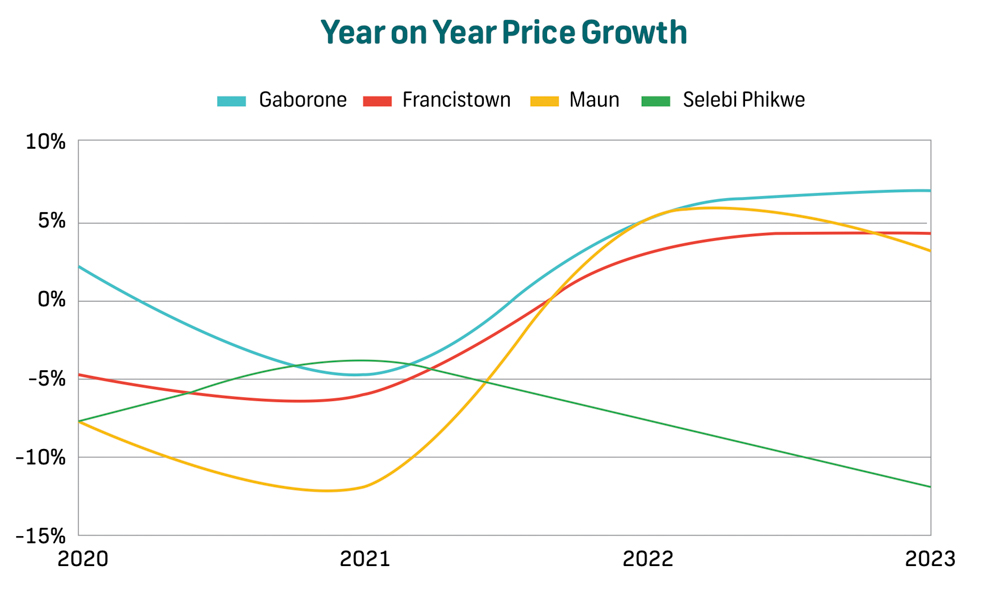

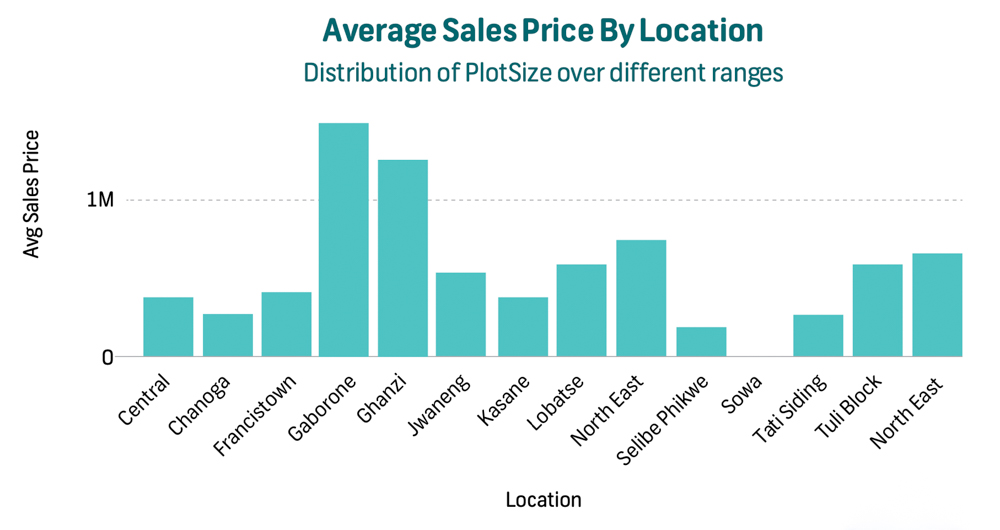

In 2023, the average sales prices for residential properties experienced a 5% increment vis-à-vis 2022, indicative of a consistent uptrend in residential property valuations.

The capital city, Gaborone, registered the most substantial price escalation at 7%, underscoring robust growth. Francistown and Maun observed moderate price upticks, with increments of 4% and 3%, respectively. To stay informed about stock market trends and investment opportunities in Botswana, visit the Botswana Stock Exchange website at BSE.

Sales Volumes:

The volume of residential property transactions augmented by approximately 6% compared to the preceding year, underscoring a burgeoning demand for housing.

Gaborone and its environs recorded the highest sales volumes propelled by urbanization and economic activity.

Secondary urban centres like Francistown also witnessed positive sales volume growth, albeit at a more measured pace. For comprehensive insights into global real estate markets, visit Global Property Guide at Global Property Guide.

Supply and Demand:

The inventory of residential properties in Botswana remained relatively stable in 2023, with a marginal uptick in new developments. Supply and Demand: The inventory of residential properties in Botswana remained relatively stable in 2023, with a marginal uptick in new developments. Demand for housing continued to outstrip supply, especially in major urban hubs, exerting upward pressure on prices. The disparity between supply and demand is anticipated to persist in the short to medium term, bolstering price appreciation.

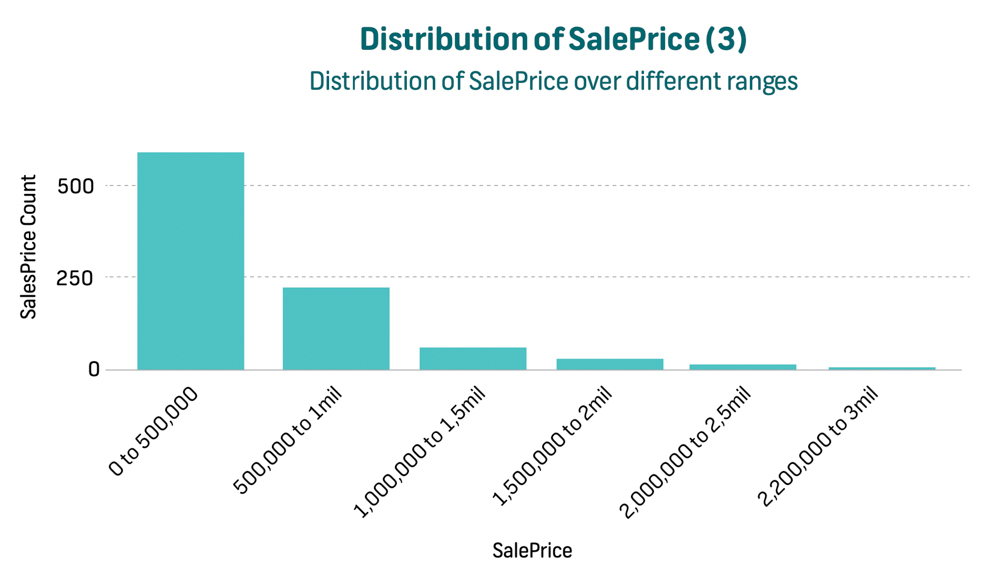

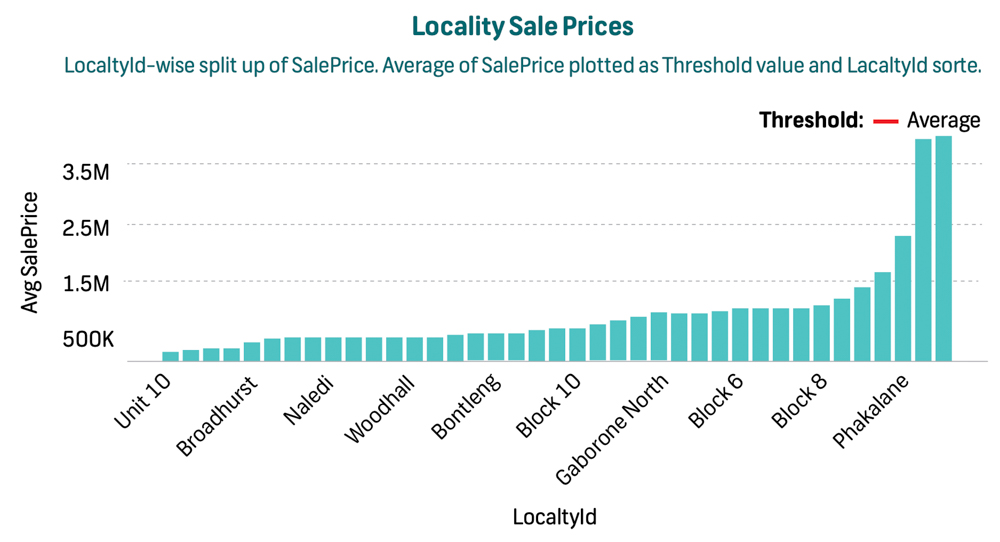

Gaborone being the highest contributor to national transactions, the above graphs show the average sales prices closed in 2023 in different Gaborone Localities. Placing Phakalane as the highest averaged priced transactions. Stay updated on legal notices and official publications related to Botswana’s real estate sector by accessing Gazettes Africa at Gazettes Africa

Commercial Market:

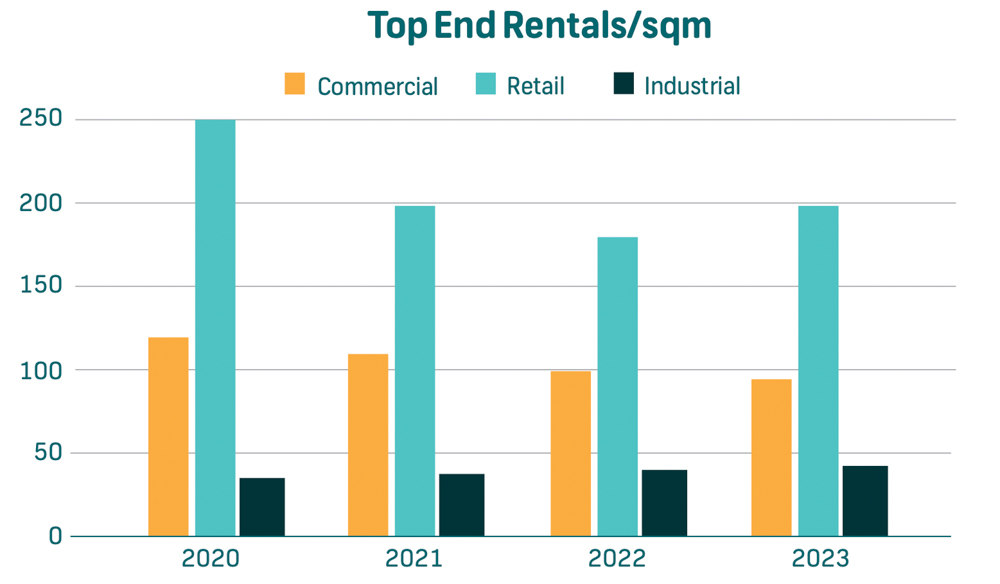

Office Space

Demand for office space remained stable in 2023.

Average rental rates for office spaces exhibited minor fluctuations, with some locales witnessing marginal increments while others remained steady. The presence of modern, well-equipped office facilities influenced tenant preferences.

Retail Space

The demand for retail space experienced significant growth in 2023, driven by the burgeoning retail sector.

Shopping malls and commercial centres witnessed heightened foot traffic, leading to elevated rental rates for prime retail locations. The advent of e-commerce had a nuanced impact on retail space demand, with certain enterprises adopting an omnichannel approach.

Industrial Property

Demand for industrial property remained relatively constant in 2023, with the manufacturing sector showing signs of recovery.

Average rental rates for industrial properties remained largely unchanged, indicative of a balanced supply-demand equilibrium. The availability of suitable industrial land and infrastructure influenced businesses’ location preferences. Explore the natural wonders and tourism attractions of Botswana at the official website of Botswana Tourism Organisation: Botswana Tourism.

COMPARISON WITH PREVIOUS YEARS

The Botswana real estate market exhibited positive performance in 2023 relative to 2022, marked by robust growth in residential sales prices and a stable commercial segment.

The market performance in 2023 mirrored that of 2021, characterised by analogous levels of sales activity and price appreciation across

residential and commercial sectors. The market appeared to have stabilised post the initial disruptions triggered by the pandemic.

The real estate market in 2023 has yet to fully rebound to pre-pandemic levels, with sales prices and rental rates still below the level attained in 2019.

The enduring ramifications of the pandemic and global economic uncertainties have impeded the pace of market recovery.

Residential Market:

Anticipated continued growth in residential sales prices in 2024, albeit at a more subdued pace. Robust demand for housing projected to

persist, propelled by population expansion, urbanisation trends, and the imperative for affordable housing solutions. The development of

integrated residential communities and mixed-use projects expected to redefine the landscape of residential real estate.

Commercial Market:

Stable demand for office space anticipated in 2024, influenced by the services sector’s growth and the adoption of hybrid work models.

The upward trajectory in retail space demand projected to continue, buoyed by the expansion of both local and international retailers. Modest growth expected in industrial property demand, as businesses seek contemporary and efficient facilities to underpin their operations.

Overall Outlook:

Cautious optimism pervades the outlook for the Botswana property market in 2024. Despite prevailing global economic uncertainties, the country’s macroeconomic fundamentals remain robust, furnishing a sturdy platform for sustained market expansion. Government initiatives geared toward promoting affordable housing and enticing foreign investment are poised to positively impact the real estate sector.